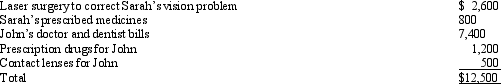

Sarah,John's daughter who would otherwise qualify as his dependent,filed a joint return with her husband Larry.John,who had AGI of $100,000,paid the following medical expenses:  John has a medical expense deduction of:

John has a medical expense deduction of:

Definitions:

Delivered by People

Delivered by people refers to services or goods provided directly to the consumer through human interaction, emphasizing the personal touch in the delivery process.

Privately Owned

Describes businesses or assets owned by individuals or non-governmental entities, as opposed to being publicly traded or government-owned.

Publicly Owned

Refers to entities or businesses that are owned by the government or the public through publicly traded shares.

Inventory Costs

Expenses associated with holding and managing inventory, including storage, insurance, and loss of goods.

Q4: In 2010,Mary traveled 800 miles for specialized

Q5: The cost recovery period for new farm

Q19: Which,if any,of the following expenses is subject

Q28: A taxpayer who claims the standard deduction

Q52: Nigel purchased a blending machine for $125,000

Q57: In 2010,Cindy invested $100,000 for a 25%

Q79: Irene and Jim own an unincorporated bakery.They

Q84: Terry and Jim are both involved in

Q123: Eric and Faye,who are married,jointly own a

Q166: A factory building owned by Amber,Inc.is destroyed