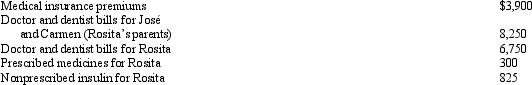

Rosita is employed as a systems analyst.For calendar year 2010,she had AGI of $120,000 and paid the following medical expenses:  José and Carmen would qualify as Rosita's dependents except that they file a joint return.Rosita's medical insurance policy does not cover them.Rosita filed a claim for $3,150 of her own expenses with her insurance company in December 2010 and received the reimbursement in January 2011.What is Rosita's maximum allowable medical expense deduction for 2010?

José and Carmen would qualify as Rosita's dependents except that they file a joint return.Rosita's medical insurance policy does not cover them.Rosita filed a claim for $3,150 of her own expenses with her insurance company in December 2010 and received the reimbursement in January 2011.What is Rosita's maximum allowable medical expense deduction for 2010?

Definitions:

Organizational Innovation

The process of creating or adopting new ideas, processes, or products within an organization to improve performance or competitiveness.

Empowerment

The process of granting individuals or groups the power and resources to make decisions, fostering independence and confidence.

Top-level Managers

Executives responsible for overseeing the strategic direction of an organization and making long-range decisions.

Adaptation

The process of adjusting or changing to fit new conditions or environments.

Q1: If a taxpayer chooses not to claim

Q16: Nikeya sells land (adjusted basis of $60,000)to

Q27: Nick made the following contributions this year

Q33: Ashley owns 200 acres of farm land

Q41: Graham,a CPA,has submitted a proposal to do

Q62: All eligible real estate under MACRS is

Q77: Which of the following is correct?<br>A)The deferral

Q82: The incremental research activities credit is 20%

Q85: Elaine,the regional sales director for a manufacturer

Q95: On May 30,2010,Jane signed a 20-year lease