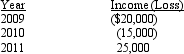

Samantha invested $75,000 in a passive activity several years ago,and on January 1,2009,her amount at risk was $15,000.Her shares of the income and losses in the activity for the next three years are as follows:

How much can Samantha deduct in 2009 and 2010? What is her taxable income from the activity in 2011? (Consider both the at-risk rules as well as the passive loss rules. )

How much can Samantha deduct in 2009 and 2010? What is her taxable income from the activity in 2011? (Consider both the at-risk rules as well as the passive loss rules. )

Definitions:

Equilibrium Wage

The remuneration level where the quantity of labor available meets the quantity of labor sought.

Pear Pickers

Individuals or workers engaged in the harvesting of pears; often used in discussions related to agriculture, labor, and seasonal employment.

Apple Pickers

Refers to laborers who are employed in the agricultural sector for the purpose of harvesting apples from orchards.

Demand Curve

A graph showing the relationship between the price of a good and the quantity of that good consumers are willing to buy.

Q10: Fees for automobile inspections,automobile titles and registration,bridge

Q54: Property used for the production of income

Q55: The cost recovery basis for property converted

Q56: Taxpayer's principal residence is destroyed by a

Q69: When a taxpayer has purchased several lots

Q69: Joyce owns an activity (not real estate)in

Q97: Faith just graduated from college and she

Q102: Jermaine and Kesha are married,file a joint

Q107: Which of the following statements is correct?<br>A)In

Q120: Section 1231 property generally does not include