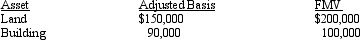

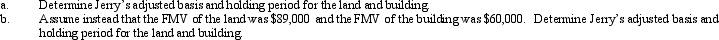

On September 18,2010,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2007,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Nutritious Meals

Meals balanced in essential nutrients like vitamins, minerals, proteins, carbohydrates, and fats, crucial for maintaining health and preventing diseases.

Holistic View

An approach that considers the whole person, including physical, mental, and social factors, rather than just focusing on individual components.

Spiritual View

An individual's perspective or belief system regarding the essence of being, often involving faith, religion, or one's sense of purpose and connection to the universe.

Biomedical View

A perspective focusing on biological factors in understanding and treating medical conditions, often underemphasizing psychological and social factors.

Q2: Gold Corporation,Silver Corporation,and Platinum Corporation are equal

Q10: Short-term capital losses are netted against long-term

Q10: Sage,Inc. ,a closely held corporation that is

Q16: In a nontaxable exchange,recognition is postponed.In a

Q20: José sells his personal residence to Manuel

Q67: Juan,not a dealer in real property,sold land

Q74: Expenditures made for ordinary repairs and maintenance

Q84: During the current year,Yellow Company had operating

Q111: Interest on a home equity loan may

Q127: Kahil exchanges a drill press that is