Multiple Choice

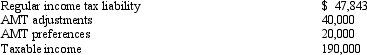

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2010.

Calculate her AMT exemption for 2010.

Definitions:

Related Questions

Q13: Thrush Corporation files Form 1120,which reports taxable

Q17: Canary Corporation,which sustained a $5,000 net capital

Q18: Ivory Fast Delivery Company,an accrual basis taxpayer,frequently

Q19: Yellow Corporation transfers land (basis of $210,000,fair

Q37: Falcon Corporation,a C corporation,had gross receipts of

Q50: Lois received nontaxable stock rights with a

Q54: For a building placed in service before

Q126: Lease cancellation payments received by a lessor

Q133: Yuki and Omana,married filing jointly,and both over

Q143: Taylor inherited 100 acres of land on