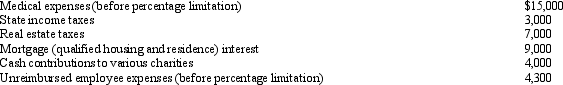

Mitch,who is single and has no dependents,had AGI of $100,000 in 2010.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

Definitions:

Electronic Human Resource Management

The integration of information technology into the human resources function to enhance its efficiency and effectiveness, often through digital platforms and tools.

Psychological Contract

A description of what an employee expects to contribute in an employment relationship and what the employer will provide the employee in exchange for those contributions.

Job Security

Refers to the likelihood that an individual will keep their job without the risk of becoming unemployed.

Knowledge Workers

Employees whose main contribution to the organization is specialized knowledge, such as knowledge of customers, a process, or a profession.

Q14: What is the general formula for calculating

Q23: A shareholder's holding period of property acquired

Q24: Pedro,not a dealer,sold real property that he

Q29: When a taxpayer incorporates her business,she transfers

Q30: Sarah and Tony (mother and son)form Dove

Q33: Janet,age 68,sells her principal residence for $500,000.She

Q61: To qualify for nonrecognition treatment,an office building

Q78: Black Corporation,an accrual basis taxpayer,was formed and

Q79: Generally,corporate net operating loss can be carried

Q112: Lynn purchases a house for $52,000.She converts