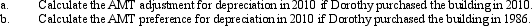

In September,Dorothy purchases a building for $900,000 to use in her business as a warehouse.Dorothy uses the depreciation method which will provide her with the greatest deduction for regular income tax purposes.

Definitions:

Chromosomes

Filamentous entities found within the nucleus of both animal and plant cells, composed of protein and a singular molecule of DNA (deoxyribonucleic acid).

Plasma Membrane

A selectively permeable lipid bilayer forming the boundary of the cells, responsible for controlling the passage of substances in and out of the cell.

Ribosomes

Cellular structures made of RNA and proteins that function as the site of protein synthesis in the cytoplasm by translating mRNA into polypeptides.

Cell Wall

A rigid layer that lies outside the cell membrane in most bacteria, plants, algae, and fungi, providing support and protection.

Q18: Samuel's hotel is condemned by the City

Q42: Reginald and Roland (Reginald's son)each own 50%

Q45: Rob and Sharon form Swallow Corporation with

Q57: Elbert gives stock worth $28,000 (no gift

Q62: Which of the following would extinguish the

Q82: Justin owns 1,000 shares of Oriole Corporation

Q96: Briefly describe the reason a corporation might

Q108: On January 18,2009,Martha purchased 200 shares of

Q116: Kenneth acquires $100,000 face value corporate bonds

Q121: Five years ago,Eleanor transferred property she had