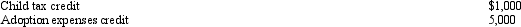

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Human Resources Misconduct

Unethical or improper behavior by HR professionals, including discrimination, privacy breaches, and mishandling of employee relations.

Résumé Diversion

A tactic used to divert attention from certain aspects of a resume by emphasizing more desirable qualifications or experiences.

Application Diversion

A strategy used in recruitment where candidates are redirected to other suitable job openings if they are not a fit for the initial position applied for.

Quality of Recruits

The measure of how well new hires fit the requirements of their roles, including skills, experience, and compatibility with the organization's culture.

Q2: Lavender,Inc. ,incurs research and experimental expenditures of

Q16: Describe the circumstances in which the maximum

Q28: A business taxpayer sells depreciable business property

Q68: Eileen transfers property worth $200,000 (basis of

Q71: Geneva,a sole proprietor,sold one of her business

Q74: Shawn,a sole proprietor,is engaged in a service

Q82: Dawn,a sole proprietor,was engaged in a service

Q111: Honeysuckle Corporation is wholly owned by Tabatha.Corporate

Q115: Under what circumstances are corporations exempt from

Q137: Magenta,Inc.sold a forklift on February 12,2010,for $3,000