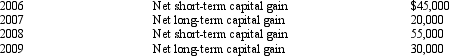

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2010.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2011.

Compute the amount of Bear's capital loss carryover to 2011.

Definitions:

Linear Programming

A mathematical technique used for allocation of resources optimally, often applied in optimizing production processes, logistics, and other operational areas.

Delphi Technique

A forecasting method that involves gathering the opinions of experts through multiple rounds of questionnaires to reach consensus on future events or decisions.

Skills Inventories

Databases or lists of the skills and qualifications that employees possess, used for managing and planning human resources.

HR Demand Requirements

The specific needs and number of human resources an organization requires to meet its strategic objectives and goals.

Q10: Which of the following statements best describes

Q15: A realized gain from a like-kind exchange

Q17: Terri's basis in her partnership interest was

Q20: The 2009 "Qualified Dividends and Capital Gain

Q42: Which of the following statements correctly reflects

Q47: A net short-term capital loss first offsets

Q50: In computing the ordinary income of a

Q59: Eve transfers property (basis of $120,000 and

Q72: Orange Company had machinery destroyed by a

Q99: In 2009,Jenny had a $12,000 net short-term