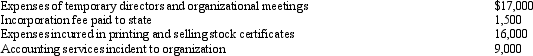

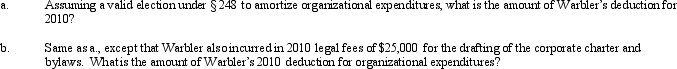

Warbler Corporation,an accrual method regular corporation,was formed and began operations on July 1,2010.The following expenses were incurred during its first year of operations (July 1 - December 31,2010):

Definitions:

Customer's Interests

Preferences, needs, or desires that customers seek to fulfill when purchasing goods or services.

Ethical Decisions

Choices made based on moral principles and values, often involving considerations of fairness, accountability, and integrity.

Job Enlargement

The grouping of a variety of tasks about the same skill level; horizontal enlargement.

Source Inspection

The practice of inspecting goods or materials at the supplier's site before they are shipped to the purchaser, to ensure they meet specified quality standards.

Q19: If a shareholder owns stock received as

Q20: Tracy and Lance,equal shareholders in Macaw Corporation,receive

Q20: The 2009 "Qualified Dividends and Capital Gain

Q35: Income from some long-term contracts can be

Q48: The gross estate of April,decedent,includes stock in

Q51: Kim owns 100% of the stock of

Q100: Nicole owns and operates a sole proprietorship.She

Q124: Thistle Corporation declares a nontaxable dividend payable

Q130: Wendy and David,equal shareholders in Loon Corporation,receive

Q144: In 2010 Angela,a single taxpayer with no