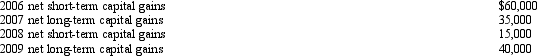

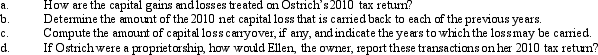

Ostrich,a C corporation,has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2010.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Cultural Capital

Social assets not related to finances that enhance social advancement apart from monetary resources, including factors like education, intelligence, manner of speaking, and manner of dress.

Folkways

Norms for routine or casual interaction that guide everyday behaviors in a society.

Mores

Social norms that are widely observed and have great moral significance within a particular society.

Taboos

Social or cultural prohibitions against certain practices, discussions, or expressions deemed unacceptable by a community.

Q3: If a partnership allocates losses to the

Q8: Originally the courts (in opposition to Congress)determined

Q16: Describe the circumstances in which the maximum

Q22: Leah transfers equipment (basis of $400,000 and

Q50: Durell owns a construction company that builds

Q76: Michelle and Jacob formed the MJ Partnership.Michelle

Q82: Betty's adjusted gross estate is $7 million.The

Q82: Justin owns 1,000 shares of Oriole Corporation

Q109: Marvin,the vice president of Lavender,Inc. ,exercises stock

Q127: Cason is filing as single and has