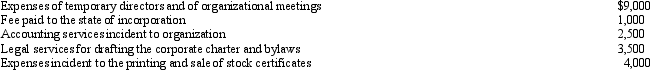

Emerald Corporation,a calendar year C corporation,was formed and began operations on July 1,2010.The following expenses were incurred during the first tax year (July 1 through December 31,2010) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2010?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2010?

Definitions:

Heart Rate

The number of heartbeats per unit of time, typically expressed in beats per minute (BPM), indicating the heart's activity level.

Digestion

The biological process by which the body breaks down food into absorbable components for energy, growth, and cell repair.

Autonomic Arousal

The involuntary activation of the autonomic nervous system, leading to physical responses such as increased heart rate, sweating, or adrenaline release.

Emotional Experiences

Emotional experiences refer to the complex feelings and reactions individuals have in response to various events, situations, or stimuli, encompassing a wide range of feelings from happiness to sadness.

Q5: Pink Corporation is an accrual basis taxpayer

Q28: Generally,deductions for additions to reserves for estimated

Q42: After a plan of complete liquidation has

Q42: Which of the following statements correctly reflects

Q47: In September,Dorothy purchases a building for $900,000

Q52: Lynn transfers property (basis of $225,000 and

Q76: Discuss the application of holding period rules

Q83: Ashley,a 70% shareholder of Wren Corporation,transfers property

Q83: Joel and Desmond are forming the JD

Q96: Sam receives a proportionate nonliquidating distribution when