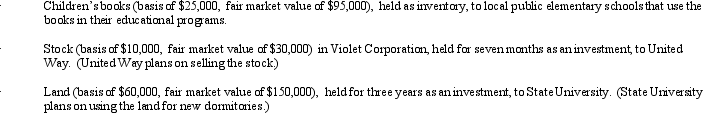

During the current year,Flamingo Corporation,a regular corporation in the book publishing business,made charitable contributions to qualified organizations as follows:

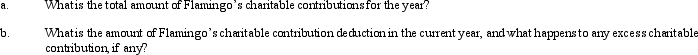

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Definitions:

Preschooler

A child typically between the ages of 3 and 5 years who is not yet attending kindergarten.

Ignore

Deliberately paying no attention to something or someone.

Parental Warmth

A parenting style characterized by affection, nurturing, and support, contributing positively to child development.

Genetic Factors

Aspects of an individual's genes or hereditary influence that affect their physical and mental characteristics, health conditions, and susceptibilities.

Q1: Discuss the treatment of losses from involuntary

Q2: The stock in Black Corporation is owned

Q7: What characteristics must the seller of a

Q29: The partnership allocates recourse debt among the

Q33: The buyer and seller have tentatively agreed

Q53: Describe the relationship between the recovery of

Q77: Jane and Walt form Yellow Corporation.Jane transfers

Q78: Black Corporation,an accrual basis taxpayer,was formed and

Q104: Omar acquires used 7-year personal property for

Q109: A security that is a capital asset