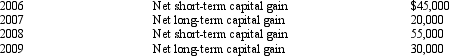

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2010.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2011.

Compute the amount of Bear's capital loss carryover to 2011.

Definitions:

Bandura

A reference to Albert Bandura, a Canadian-American psychologist known for his work on social learning theory, which emphasizes the role of observational learning, modeling, and self-efficacy in behavior.

Model Behavior

Demonstrating a desired behavior as an example for others to emulate.

Learn

The acquisition of knowledge or skills through experience, study, or by being taught.

Watching Others

The act of observing the behaviors, actions, or interactions of others, often to learn, analyze, or simply out of curiosity.

Q4: A cash basis taxpayer sold investment land

Q7: Adam transfers cash of $300,000 and land

Q20: Tracy and Lance,equal shareholders in Macaw Corporation,receive

Q41: Hazel,Emily,and Frank,unrelated individuals,own all of the stock

Q44: Glenda is the sole shareholder of Condor

Q79: Holly and Marcus formed a partnership.Holly received

Q99: Which of the following statements regarding constructive

Q114: Fern,Inc. ,Ivy Inc. ,and Jason formed a

Q115: On July 1,2010,Brandon purchased an option to

Q135: Robin Corporation has ordinary income from operations