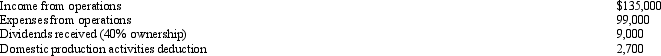

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Negligent Act

Conduct falling below the standard of care expected to protect others against unreasonable risk of harm.

Limited Partner

A type of investor in a partnership who has limited liability to the extent of their investment and typically does not participate in daily business management.

Statutory Provisions

Laws or regulations enacted by the legislative body that must be adhered to.

Liability

The condition of having legal accountability, especially regarding debts or legal duties.

Q8: In the current year,Pink Corporation has a

Q22: Schedule K of Form 1065 reports the

Q27: The purpose of the AMT is to

Q36: For a corporate restructuring to qualify as

Q39: Jake,the sole shareholder of Peach Corporation,a C

Q46: Ramon sold land in 2010 with a

Q67: In a proportionate nonliquidating distribution,cash is deemed

Q74: Tan,Inc. ,has a 2010 $50,000 long-term capital

Q81: On January 1,Cotton Candy Corporation (a calendar

Q140: "Collectibles" held long-term and sold at a