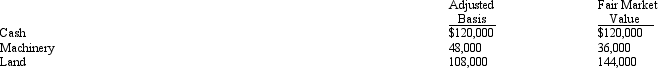

Hazel transferred the following assets to Starling Corporation.  In exchange,Hazel received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Starling Corporation five years ago.

In exchange,Hazel received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Starling Corporation five years ago.

Definitions:

Autism Spectrum Disorder

A developmental disorder characterized by difficulties in social interaction and communication, along with restricted or repetitive patterns of thought and behavior.

Pervasive Developmental Disorder

A category of developmental disorders that involve delays in the development of many basic skills, often replaced by the term Autism Spectrum Disorder.

Tay-Sachs Disease

A genetic disorder that destroys nerve cells in the brain and spinal cord.

Developmental Disabilities

A diverse group of conditions due to an impairment in physical, learning, language, or behavior areas that begin during the developmental period.

Q3: The taxpayer voluntarily changed from the cash

Q5: Pink Corporation is an accrual basis taxpayer

Q14: Describe the Federal tax treatment of entities

Q16: Describe the circumstances in which the maximum

Q45: Land that originally cost $100,000 is sold

Q58: Beige Corporation (a calendar year taxpayer)has taxable

Q61: Which of the following is not an

Q104: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q111: Interest on a home equity loan may

Q135: Kevin,Chuck,and Greg contributed assets to form the