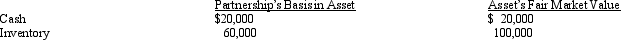

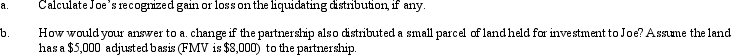

Joe has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $200,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Joe.

Definitions:

Education System

Comprises the institutions, policies, procedures, and practices that provide formal learning experiences, from primary to tertiary levels.

Socialization

is the process through which individuals learn and adopt the values, norms, and societal rules necessary to function and participate within their culture.

Totems

Objects that symbolize the sacred.

Sacred

The sacred refers to the religious, transcendent world.

Q11: Apple,Inc. ,a cash basis S corporation in

Q27: Which of the following is not a

Q28: Bert Corporation,a calendar-year taxpayer,owns property in States

Q32: Which corporation is eligible to make the

Q34: A corporate shareholder that receives a constructive

Q39: Discuss any negative tax consequences that result

Q48: Define average acquisition indebtedness with respect to

Q50: Which of the following statements is correct

Q78: Swan,Inc. ,a tax-exempt organization,leases a building and

Q85: The gross estate of Raul,decedent who died