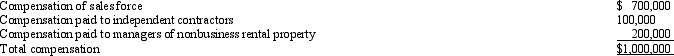

State D has adopted the principles of UDITPA.Given the following transactions for the year,determine Comp Corporation's D payroll factor denominator.

Definitions:

CCA

Capital Cost Allowance, a tax deduction in Canada that represents depreciation for capital assets.

Exempt Assets

Exempt assets refer to properties or investments that are shielded from creditors during bankruptcy or legal judgments, often including a portion of the individual's home, car, and personal belongings depending on the jurisdiction.

Specified Leasing

A leasing agreement in which the terms, including the lease duration, payment schedule, and type of asset, are explicitly stated.

Manufacturing Tools

Instruments, machines, or related items used in the manufacturing process to produce goods and products.

Q7: Juanita,who is subject to a 45% marginal

Q21: Quadrant,Inc. ,is a former C corporation whose

Q32: Summarize the principles of multistate tax planning.

Q36: Distributions from retirement plans and proceeds from

Q38: José Corporation realized $600,000 taxable income from

Q39: Your client is a C corporation that

Q82: Which of the following is one of

Q87: Using his separate funds,Wilbur purchases an annuity

Q106: Which of the following are exempt organizations?<br>A)National

Q149: A partner has a profit-sharing percent,a loss-sharing