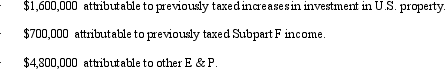

\Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.  Benchmark recognizes a taxable dividend of:

Benchmark recognizes a taxable dividend of:

Definitions:

Psychological Job Withdrawal

A process by which employees detach from their work roles, often manifesting through reduced engagement, effort, and commitment.

Physical Withdrawal

The act of an employee disengaging from work-related activities, often signaling dissatisfaction or disinterest in the job.

Principles of Justice

Fundamental moral guidelines that dictate fair treatment and equitable distribution of benefits and burdens among individuals.

Discharging Employees

The process of officially ending an employee's tenure with an organization, often due to redundancy, performance issues, or misconduct.

Q14: Adam contributes property with a fair market

Q35: Gain or loss on the exchange of

Q43: Both Accounts Receivable and Notes Receivable represent

Q55: The Prasad Trust operates a welding business.Its

Q60: Which statement appearing below does not correctly

Q72: Is there a materiality exception associated with

Q92: The Code defines a "simple trust" as

Q94: Qualified state tuition programs are exempt from

Q115: Pepper,Inc. ,an S corporation in Norfolk,Virginia,has revenues

Q122: Dividends received from a domestic corporation are