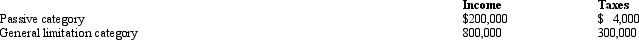

BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays foreign taxes as follows.

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

Definitions:

Earnings Claims

Statements made by a company or franchise about the potential or actual financial performance of a business opportunity.

Reasonable Basis

A standard of evidence that suggests a belief or action is supported by a fair amount of facts or logical assumptions, often used in legal and regulatory contexts.

Franchisor

The original business or company that grants the license to third-party operators to conduct business under its name and system.

Hypothetical Basis

A theoretical foundation or scenario used for analysis or argument, often constructed to explore possibilities or outcomes.

Q22: A nonresident alien with U.S.-source income effectively

Q32: Which corporation is eligible to make the

Q40: In 1980,Marie and Hal (mother and son)purchased

Q48: Define average acquisition indebtedness with respect to

Q49: An appropriate transfer price is one that

Q55: A feeder organization is exempt from Federal

Q68: Why is it advantageous for both the

Q100: Which of the following exempt organizations are

Q105: José Corporation realized $600,000 taxable income from

Q111: Income from international communications activities earned by