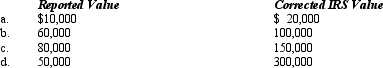

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Definitions:

Four-Firm Sales Concentration Ratio

The percentage of total industrial sales accounted for by the four largest firms within a specific market, used to measure the degree of market concentration.

Geographic Concentration

The phenomenon of economic activity or specific industries clustering in specific regions or areas.

X-Inefficiency

Occurs when a firm fails to utilize its resources efficiently, due to factors like lack of competitive pressure or managerial inefficiencies.

Homogeneous Product

A product that is considered identical or nearly identical to another product from a different producer.

Q15: Describe how an estate or trust treats

Q25: Which of the following statements regarding translation

Q55: A(n)_ business operates its separate companies as

Q75: No overvaluation penalty is incurred by an

Q76: Leroy,who is subject to a 45% marginal

Q101: This year,the Nano Trust reported $50,000 entity

Q116: At the time of his death,Asa held

Q122: Under Circular 230,a return must be signed

Q135: Miles is a citizen of France and

Q137: USCo,a domestic corporation,receives $700,000 of foreign-source passive