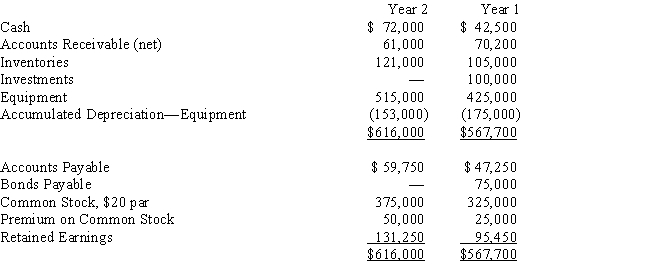

The comparative balance sheets of Barry Company,for Years 1 and 2 ended December 31,appear below in condensed form.  Additional data for the current year are as follows:

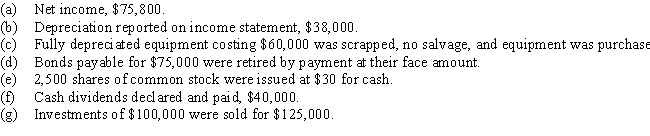

Additional data for the current year are as follows:  Prepare a statement of cash flows using the indirect method.

Prepare a statement of cash flows using the indirect method.

Definitions:

Dividend Growth

How quickly a corporation raises the dividend sums given to its shareholders as time progresses.

Rate Of Return

The profitability or unprofitability encountered in an investment over a defined period, denoted as a percentage of the investment's commencement cost.

Stock Price

The cost at which a share of stock is bought or sold in the market, reflecting the company's current value as perceived by investors.

Required Return

The minimum rate of return an investor expects to receive from an investment.

Q2: The net income reported on the income

Q11: The percent of fixed assets to total

Q32: In order to maintain a record of

Q61: Which of the following types of transactions

Q76: For each of the following,identify whether it

Q78: Ratio of liabilities to stockholders' equity<br>A)Assess the

Q117: The following information was taken from the

Q128: The cumulative effects of other comprehensive income

Q129: If an owner wanted to know how

Q146: The amount of interest paid when buying