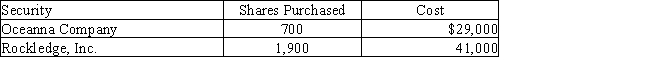

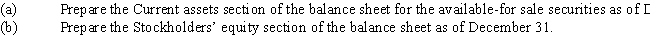

During the first year of operations,Makala Company purchased two available-for-sale investments as follows:  Assume that as of December 31,Oceanna Company's stock had a market value of $49 per share and Rockledge,Inc.'s stock had a market value of $20 per share.Makala had 10,000 shares of no par stock outstanding that was issued for $150,000.For the year ending December 31,Makala had a net income of $105,000.No dividends were paid.

Assume that as of December 31,Oceanna Company's stock had a market value of $49 per share and Rockledge,Inc.'s stock had a market value of $20 per share.Makala had 10,000 shares of no par stock outstanding that was issued for $150,000.For the year ending December 31,Makala had a net income of $105,000.No dividends were paid.

Definitions:

Bond

A long-term debt security that is secured by collateral.

Estate Value

The total net worth of an individual's assets at the time of their death, after deducting debts and liabilities.

Joint Tenants

Co-owners of property who have equal shares and rights in the property, with a right of survivorship.

Right Of Survivorship

A legal concept where property automatically transfers to the surviving co-owner(s) upon the death of another co-owner.

Q23: When the cost method is used to

Q38: A balance sheet that displays only component

Q57: If Dakota Company issues 1,500 shares of

Q63: On January 1,$2,000,000,five-year,10% bonds,were issued for $1,960,000.Interest

Q71: On October 1,Marcus Corporation purchased $20,000 of

Q117: The following information was taken from the

Q138: When a corporation issues bonds,it executes a

Q141: Using the following table,what is the present

Q186: An acceleration in the collection of receivables

Q198: Earnings per share amounts are only required