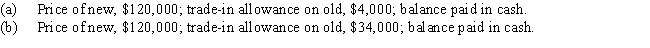

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000

(including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Definitions:

Gasoline

A fluid energy source obtained from crude oil, predominantly utilized to operate engines based on internal combustion.

Supply (S)

The total amount of a specific good or service that is available to consumers at various prices over a certain period.

Demand (D)

In economic terms, the quantity of a good or service that consumers are willing and able to purchase at various prices during a given period.

Substitute

A good or service that can be used in place of another, allowing consumers to switch between them based on price, preference, or availability.

Q4: Treatment of acute coronary syndrome with non-ST-segment

Q7: Expectorants work by increasing the amount of

Q8: A rescue dosage of surfactant calls for

Q40: When calculating drug dosages based on a

Q49: Leukotriene modifiers can be used as an

Q64: Walkways to surround new business location<br>A)Land improvements<br>B)Buildings<br>C)Land<br>D)Machinery

Q83: Fixed assets are ordinarily presented on the

Q90: Scott Company sells merchandise with a one-year

Q146: FICA-Medicare<br>A)Amount is limited, withheld from employee only<br>B)Amount

Q156: As a company records depreciation expense for