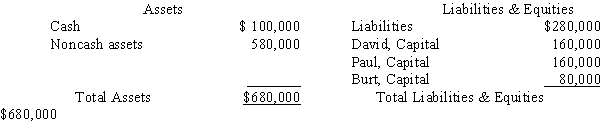

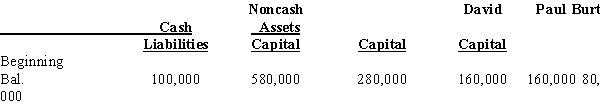

David,Paul,and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3,respectively.Immediately prior to liquidation,the following balance sheet was prepared:

Required:

Required:

Assuming the noncash assets are sold for $300,000,determine the amount of cash to be distributed to each partner.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.No cash is available from any of the three partners.

Definitions:

Advertisement

A public announcement or display promoting a product, service, or event to attract or increase interest from the target audience.

Passive Verbs

Passive verbs form sentences where the subject is the recipient of an action, rather than the doer, emphasizing the action or experience over the actor.

Assigning Blame

The act of pointing out or attributing responsibility for a fault or wrong to a person or group.

Nonracist

Refers to words, images, or behaviors that do not discriminate against people on the basis of race.

Q8: Which of the following is essential for

Q8: For the fall semester of 2017,Irving College

Q10: Fund entities may be classified as expendable

Q15: Consider the following information:<br>1.On November 1,2017,a U.S.firm

Q17: Paid-in capital accounts are translated using the

Q23: A wholly owned subsidiary of a U.S.parent

Q24: P Company purchased 96,000 shares of the

Q35: A transaction gain or loss at the

Q45: At which of the following positions is

Q67: Explain why upwelling occurs along the California