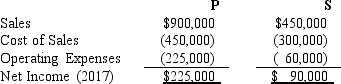

P Company owns an 80% interest in S Company.During 2017,S sells merchandise to P for $150,000 at a profit of $30,000.On December 31,2017,50% of this merchandise is included in P's inventory.Income statements for P and S are summarized below:  Noncontrolling interest in income for 2017 is:

Noncontrolling interest in income for 2017 is:

Definitions:

Equity Method

An accounting technique used to record investments in other companies, where the investment is initially recorded at cost and adjusted thereafter for the investor's share of the investee's net income or loss.

Investee Earnings

The portion of income attributable to an investor from its investment in an associated company.

Cash Dividends

Payments made by a corporation to its shareholders from the company's profits.

Q1: On July 15,Pinta,Inc.purchased 88,500,000 yen Pinta of

Q6: In a troubled debt restructuring involving a

Q11: On November 1,2016,Jagged Company sold inventory to

Q13: SFAS 141R requires that the acquirer disclose

Q19: What is the most common cause of

Q25: P Company purchased land from its 80%

Q29: P Corporation purchased an 80% interest in

Q31: Which of the following may be used

Q32: Assessing for adherence with prescribed medications and

Q32: It is proper to recognize revenues or