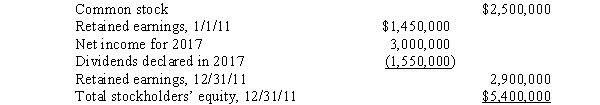

The following balances were taken from the records of S Company:

P Company owns 80% of the common stock of S Company.During 2017,P Company purchased merchandise from S Company for $4,000,000.S Company sells merchandise to P Company at cost plus 25% of cost.On December 31,2017,merchandise purchased from S Company for $1,250,000 remains in the inventory of P Company.On January 1,2017,P Company's inventory contained merchandise purchased from S Company for $525,000.The affiliated companies file a consolidated income tax return.There was no difference between the implied value and the book value of net assets acquired.

P Company owns 80% of the common stock of S Company.During 2017,P Company purchased merchandise from S Company for $4,000,000.S Company sells merchandise to P Company at cost plus 25% of cost.On December 31,2017,merchandise purchased from S Company for $1,250,000 remains in the inventory of P Company.On January 1,2017,P Company's inventory contained merchandise purchased from S Company for $525,000.The affiliated companies file a consolidated income tax return.There was no difference between the implied value and the book value of net assets acquired.

Required:

A.Prepare all workpaper entries necessitated by the intercompany sales of merchandise.

B.Compute noncontrolling interest in consolidated income for 2017.

C.Compute noncontrolling interest in consolidated net assets on December 31,2017.

Definitions:

Q1: The amount of a long-lived asset impairment

Q2: The objective of remeasurement is to:<br>A)produce the

Q4: According to World Health Organization data on

Q6: In a business combination accounted for as

Q14: The patient with BPH is seen for

Q16: The main mechanism for avoiding a lawsuit

Q19: There are a number of business situations

Q27: In the year an 80% owned subsidiary

Q39: Pell Company purchased 90% of the stock

Q89: By volume, which of the following are