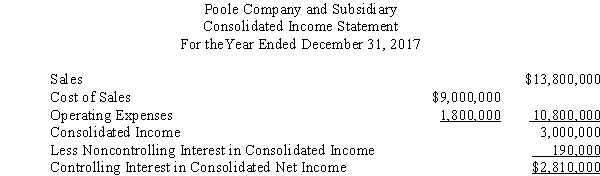

Poole Company owns a 90% interest in Solumbra Company.The consolidated income statement drafted by the controller of Poole Company appeared as follows:

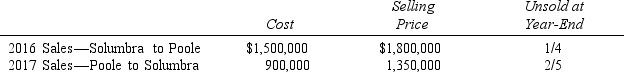

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement.Information relating to intercompany sales and unrealized intercompany profit is as follows:

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement.Information relating to intercompany sales and unrealized intercompany profit is as follows:

Required:

Required:

Prepare a corrected consolidated income statement for Poole Company and Solumbra Company for the year ended December 31,2017.

Definitions:

Price of Labor

The compensation received by employees for their work, typically measured as an hourly wage or annual salary.

Isoquant

A curve depicting all the combinations of inputs that result in the production of a specific amount of output, illustrating the concept of production efficiency.

Roller Skates

Shoes, or bindings worn on shoes, equipped with four wheels for skating on surfaces, popular as a form of recreation or sport.

Capital

The wealth, whether in money or assets, used in the production of more wealth.

Q2: In accounting for loan funds,revenue is recorded

Q3: On January 1,2016,Pilsner Company acquired an 80%

Q15: Prune Company purchased 80% of the outstanding

Q16: Accounts are listed below for a foreign

Q20: The partnership of Gilligan,Skipper,and Ginger had total

Q23: On November 1,2017,American Company sold inventory to

Q24: On January 1,2017,Roswell Systems,a U.S.-based company,purchased a

Q32: Most property,plant and equipment transactions of hospitals

Q33: During the liquidation of the partnership of

Q37: On January 1,2016,Prima Corporation acquired 80 percent