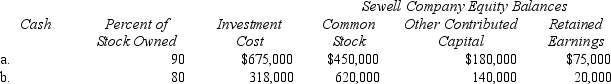

Prepare in general journal form the workpaper entries to eliminate Porter Company's investment in Sewell Company in the preparation of a consolidated balance sheet at the date of acquisition for each of the following independent cases:

Any difference between book value of net assets acquired and the value implied by the purchase price relates to subsidiary property,plant,and equipment except for case (b).In case (b)assume that all book values and fair values are the same.

Any difference between book value of net assets acquired and the value implied by the purchase price relates to subsidiary property,plant,and equipment except for case (b).In case (b)assume that all book values and fair values are the same.

Definitions:

Q1: Triggering factors for acute exacerbations of which

Q9: It is important for the clinician to

Q9: Which person is four times more likely

Q9: The amount of the adjustment to the

Q10: There are many pressures inherent in primary

Q15: Maplewood Corporation purchased the net assets of

Q16: The fair value of net identifiable assets

Q16: Search Company is a 90% owned subsidiary

Q28: A parent company's equity interest in a

Q29: What percentage of patients with angina pectoris