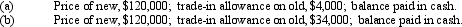

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date) is exchanged for similar machinery. For financial reporting purposes, present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

Definitions:

Average Tax Rate

The percentage of income that is paid to the government as tax, calculated by dividing the total tax amount by the total income.

Payroll Taxes

Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay their staff.

Medicare Taxes

Taxes collected in the United States to fund the Medicare program, which provides healthcare to the elderly and disabled.

Average Tax Rate

The percentage of an individual's or entity's gross income that is paid in taxes.

Q3: Site specific recombination only occurs for homologous

Q6: Identify the element that is the best

Q9: Identify a key service provided by the

Q20: Inventory controls start when the merchandise is

Q20: Determine the amount to be added to

Q47: Safeguarding inventory and proper reporting of the

Q52: The maturity value of a note receivable

Q101: The following lots of a particular

Q124: The bank reconciliation<br>A) should be prepared by

Q154: Brutus Corporation, a newly formed corporation, has