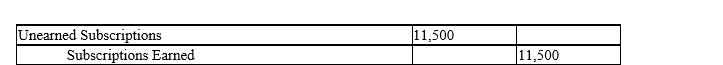

How will the following adjusting journal entry affect the accounting equation?

Definitions:

Social Security Administration

A U.S. government agency that administers social security, a social insurance program consisting of retirement, disability, and survivors benefits.

W-3 Transmittal Form

A tax form used by employers to report the total earnings, Social Security wages, Medicare wages, and withholding for all employees for a year.

Federal Withholding Methods

Procedures the IRS sets for employers to withhold taxes from employees' paychecks, impacting the employees' net income and tax liabilities.

Backup Withholding

A form of withholding on certain income such as interest and dividends for taxpayers who fail to provide their correct taxpayer identification number (TIN) to payers.

Q1: Use the work sheet for Finley Company

Q6: The management of Zesty Corporation is considering

Q13: An adjusting entry to accrue an incurred

Q22: Which of the following is not true

Q31: By ignoring and not posting the adjusting

Q83: The matching concept requires expenses be recorded

Q98: Schedule of Activity Costs<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2083/.jpg" alt="Schedule

Q126: Which of the following is the proper

Q202: When the perpetual inventory system is used,

Q217: Prepare a multiple-step income statement for Armour