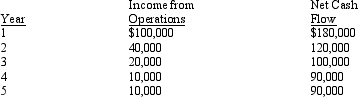

The management of Zesty Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The cash payback period for this investment is:

The cash payback period for this investment is:

Definitions:

Risk-Free Rate

The risk-free rate is the theoretical return on an investment with zero risk, serving as a benchmark for measuring investment performance.

Q10: The rate of return on investment may

Q39: It is beneficial for two related companies

Q53: By matching revenues and expenses in the

Q78: Under a JIT environment, employees have the

Q80: The local college is aggressively working in

Q109: _ manufacturing philosophy emphasizes quality and zero

Q128: The total manufacturing cost variance consists of:<br>A)

Q144: The negotiated price approach allows the managers

Q146: What is the present value of $8,000

Q167: Project A requires an original investment of