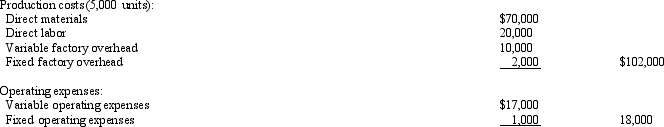

A business operated at 100% of capacity during its first month and incurred the following costs:

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what would be the amount of income from operations reported on the absorption costing income statement?

Definitions:

Corporate Profits Tax

A levy placed on the profit of corporations, calculated as the net income of the firm after deducting costs and expenses.

Individual Income Tax Rate

The percentage of an individual’s income that is paid to the government as tax.

Partnerships

A type of business organization where two or more individuals own and operate the business, sharing profits and losses.

Proprietorships

Business entities that are owned and operated by a single individual, with no legal distinction between the owner and the business.

Q6: The total manufacturing cost variance is<br>A) the

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2083/.jpg" alt=" Calculate the Direct

Q22: Next year's sales forecast shows that 20,000

Q40: Under which inventory costing method could increases

Q85: The benefits of comparing actual performance of

Q104: An account is said to have a

Q117: If a business sells two products, it

Q129: A department store has budgeted sales of

Q144: A business operated at 100% of capacity

Q181: The budget process involves doing all the