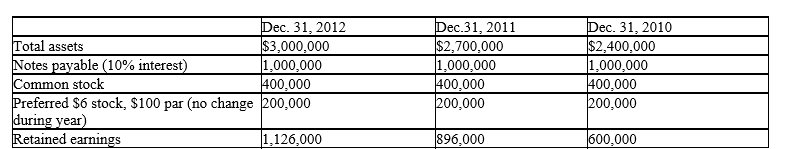

The following selected data were taken from the financial statements of the Berrol Group for December 31, 2012, 2011, and 2010:

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

Definitions:

Adjusted Trial Balance

A listing of all company accounts and their balances after adjustments, serving as the basis for financial statement preparation.

Return on Assets Ratio

A measure of how effectively a company uses its assets to generate profit, calculated as net income divided by total assets.

DuPont Approach

A method of performance measurement that breaks down return on equity (ROE) into three components: operating efficiency, asset use efficiency, and financial leverage, to help analyze a company's financial condition.

Return on Assets Ratio

A profitability ratio that indicates how efficiently a company uses its assets to generate profit, calculated as net income divided by total assets.

Q1: Operating expenses are product costs and are

Q15: Any unamortized premium should be reported on

Q34: If the accounts receivable turnover for the

Q46: Using the following table, what is the

Q81: Horizontal analysis of comparative financial statements includes

Q116: Manufacturers use labor, plant, and equipment to

Q122: The costs of materials and labor that

Q141: A company with working capital of $720,000

Q160: Beginning work in process is equal to:<br>A)

Q171: The journal entry a company records for