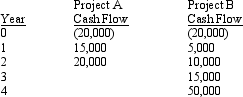

You are considering the following two mutually exclusive projects. Using the replacement chain approach and a cost of capital of 10%, calculate the NPV of Project A. (Round to nearest $)

Definitions:

Cold War

A period of geopolitical tension between the Soviet Union and the United States and their respective allies, characterized by threats, propaganda, and other measures short of open warfare, from about 1947 to 1991.

North Atlantic Treaty Organization

A military alliance formed in 1949 by countries in North America and Europe to provide collective security against aggression.

NATO

The North Atlantic Treaty Organization, a military alliance established in 1949 for mutual defense against aggression, comprising member countries from Europe and North America.

Political Elites

Individuals or groups that hold significant power and influence within a political system, often shaping policies and decisions.

Q2: The profitability index is a variation of

Q46: Managers who have an interest in project

Q57: In the case of a replacement proposal,

Q62: The NPV and IRR derived from estimated

Q62: Zimmer's common stock sells for $37 and

Q76: What type of option is the right

Q92: Decision tree analysis shows a project to

Q105: Zimmerman Inc. issued $1,000, 25-year bonds 5

Q113: The appropriate discount rate used in NPV

Q157: The underlying principles of portfolio theory include:<br>A)