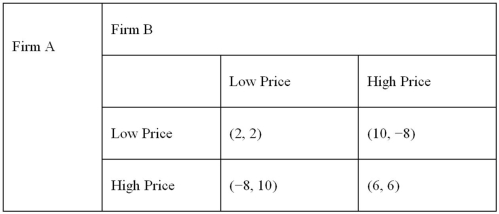

The figure below presents information for a one-shot game.  What are secure strategies for firm A and firm B respectively?

What are secure strategies for firm A and firm B respectively?

Definitions:

Compound Return

The total amount of money gained or lost on an investment over a specified period, calculated by taking into account the effect of compounding.

Volatility

The statistical measure of the dispersion of returns for a given security or market index, often associated with the degree of risk involved.

Risk Premium

The additional return an investor demands for taking on additional risk above the risk-free rate.

Expected Rate

The expected rate refers to the forecasted return on an investment or the predicted growth rate of an asset over a specific period.

Q18: Some firms find conglomerate mergers advantageous since

Q28: What is the primary facet of monopolistic

Q42: The number of efficient plants compatible with

Q62: Which of the following is a correct

Q62: Describe the difference between fixed and floating

Q75: Firm A has a higher marginal cost

Q84: Nonexclusionary, as it relates to public goods,

Q91: Suppose a monopoly faces an inverse demand

Q113: Which group of policies aims at extracting

Q124: Which of the following statements is NOT