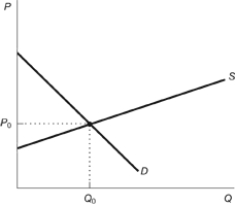

Figure: Commodity Tax with Elastic Supply  According to the figure, who bears the greater burden of the tax?

According to the figure, who bears the greater burden of the tax?

Definitions:

Variable Costing

A cost accounting method that only includes variable production costs in the cost of goods sold, excluding fixed manufacturing overhead.

Net Operating Income

A measure of a company's profitability, calculated as the difference between its total revenue and its total operating expenses, excluding taxes and interest.

For The Month

A time-based reference indicating that an action, report, or measurement pertains to the duration of a specific month.

Variable Costing

An accounting method that includes only variable production costs in the cost of goods sold and treats fixed production costs as period expenses.

Q12: Why has the Earned Income Tax Credit

Q38: (Figure: Market Equilibrium) Refer to the figure.

Q74: In a successful economy, no firm should

Q77: The central planning approach fails to achieve

Q115: What happens to total revenue when demand

Q131: (Figure: Basic Supply and Demand) In the

Q137: A market can be described by the

Q147: Suppose that a group of humans build

Q174: What links the flower growers in Kenya

Q197: If demand is elastic, a price _