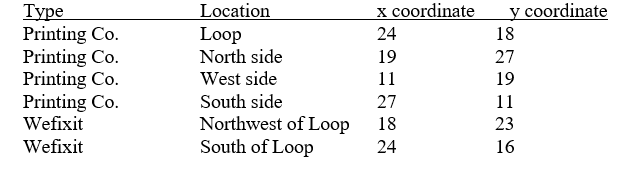

Wefixit Co. has just signed a contract to handle copy machine repairs for a large printing company in Chicago. The contract covers copy machines at four locations, in the Loop (downtown), on the North side, on the West side, and on the South side. Wefixit has identified two potential sites for housing their equipment, spare parts, and employees. One site is Northwest of the Loop, and the other on is south of the Loop. The x, y coordinates for the printing company locations and potential sites for Wefixit are as follows:

The estimate number of trips per year to each Printing Co. location is: 400 to Loop, 200 to North side, 200 to West side and 100 to South side.

(a)Calculate the total load-distance value from each potential Wefixit location.

(b)Where should Wefixit be located?

Definitions:

Form 6198

An IRS form used by taxpayers to determine the amount of at-risk activities loss that is deductible for the tax year.

At-Risk Amounts

At-Risk Amounts refer to the amount of money an individual could lose in an investment or venture, indicating the level of risk involved in the investment.

At-Risk Amount

The maximum amount of money or other assets that a taxpayer can claim as a deduction or loss from an activity, to the extent of the actual economic risk.

Material Participation Activities

Activities in which taxpayers are involved on a regular, continuous, and substantial basis in business operations.

Q8: Job design ensures that each employee's activities

Q22: Which of the following is not a

Q58: What type of aggregate plan maintains a

Q61: The first unit of a product took

Q62: Explain the Reactive vs. Proactive Demand-based options.

Q62: Compare the minimum versus maximum cycle time

Q72: The textbook discusses that in the service

Q80: The objective of quality at the source

Q104: Suppose that you have calculated the control

Q112: Which of the following statements is not