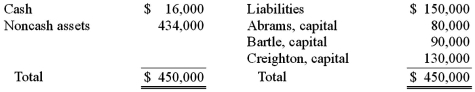

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.

After the liquidation expenses of $12,000 were paid and the noncash assets sold, Creighton had a deficit of $8,000. For what amount were the noncash assets sold?

Definitions:

Fair Value Enterprise Method

A methodology for valuation that estimates the value of an entire enterprise as if it were traded in the market, based on the fair value of its assets and liabilities.

Consolidated Balance Sheet

A financial statement that aggregates the financial position of a parent company and its subsidiaries, presenting them as a single economic entity.

Consolidated Financial Statements

Financial statements that show the financial results of a parent company and its subsidiaries as if they were a single entity.

Non-Wholly Owned Subsidiaries

Subsidiaries in which the parent company owns more than 50% but less than 100% of the subsidiary's voting stock.

Q7: The disadvantages of the partnership form of

Q15: X-Beams Inc. owned 70% of the voting

Q16: The City of Kamen collected $17,000 from

Q33: Overstated fingernail polish and nail art is

Q40: A partnership began its first year of

Q46: The partners of Donald, Chief & Berry

Q59: On October 1, 2011, Eagle Company forecasts

Q72: Which statement is not correct?<br>A) Governmental funds

Q75: Ryan Company owns 80% of Chase Company.

Q110: Stevens Company has had bonds payable of