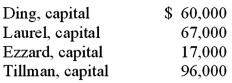

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold, for $228,000 what is the minimum amount that Tillman's creditors would have received?

Definitions:

U.S. Air Force Academy

The U.S. Air Force Academy is a military academy for officer candidates of the United States Air Force and Space Force, located in Colorado Springs, Colorado.

Legitimizing Myth

A belief or narrative adopted by a society that justifies its norms, values, and practices, often reinforcing power structures.

Mythology

A collection of myths, typically of a particular religion or culture, that contain stories about gods, heroes, and the natural world, explaining the origins and meaning of life and the universe.

Fairy Tale

A story, often for children, involving fantastical elements, characters, and plots, teaching moral lessons.

Q10: The partners of Donald, Chief & Berry

Q11: The reporting of the fund balance of

Q38: On March 1, 2011, Mattie Company received

Q40: For each of the following transactions, select

Q43: The Town of Portsmouth has at the

Q44: The _ of an email describes its

Q48: Dilty Corp. owned a subsidiary in France.

Q63: Harding, Jones, and Sandy is in the

Q95: Under the temporal method, depreciation expense would

Q100: Davidson, Inc. owns 70 percent of the