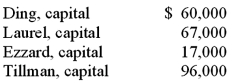

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold for $228,000, what is the minimum amount that Ezzard's creditors would have received?

Definitions:

Cash Dividends

The issuing of cash dividends from earnings to shareholders by a corporation.

Income Statement

A financial statement that shows a company’s revenue, expenses, and profit over a specific period.

Statement Of Retained Earnings

A financial report detailing the variations in retained earnings over a certain timeframe.

Balance Sheet

A financial statement that shows a company’s assets, liabilities, and shareholders' equity at a specific point in time, providing a snapshot of its financial condition.

Q10: If your e-mail message contains several points,

Q22: In today's workplace, it is acceptable and

Q32: A U.S. company buys merchandise from a

Q33: In governmental accounting, what term is used

Q39: What are the five types of governmental

Q40: The primary types of budgets include:<br>A) Divisional,

Q57: Goehring, Inc. owns 70 percent of Harry,

Q60: On October 1, 2011, Eagle Company forecasts

Q67: Directional statements include:<br>A) Mission, vision, and value

Q96: The purpose of business is to make