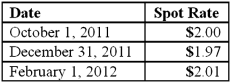

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the amount of option expense for 2012 from these transactions?

Definitions:

Job Satisfaction

The level of contentment employees feel about their work, which can affect their performance and overall well-being.

Organizational Behavior

The study of how individuals and groups interact within an organization, focusing on ways to improve efficiency and productivity.

Cognitive Dissonance

The mental discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time.

Job Satisfaction

The level of contentment employees feel towards their jobs, involving aspects like work environment, duties, and compensation.

Q4: The following account balances were available for

Q17: What information is required in the financial

Q23: Stiller Company, an 80% owned subsidiary of

Q23: McGuire Company acquired 90 percent of Hogan

Q24: Kennedy Company acquired all of the outstanding

Q59: Panton, Inc. acquired 18,000 shares of Glotfelty

Q65: Where do dividends paid to the non-controlling

Q71: Perry Company acquires 100% of the stock

Q74: Perry Company acquires 100% of the stock

Q101: Which of the following statements is true