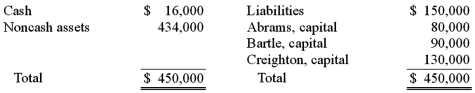

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.

If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

Definitions:

Revenue Recognition Criteria

The set of guidelines that determines the specific conditions under which revenue is recognized in the accounting period.

Fixed-Price Contract

A contract where the service or product delivery price is agreed upon before the work begins, regardless of the actual costs incurred during the project.

IFRS

International Financial Reporting Standards, a set of accounting rules followed by companies internationally to maintain consistency in financial reporting.

Completed Contract Method

An accounting method that recognizes revenue and expenses of a long-term project only when the project is completed, often used in construction accounting.

Q7: According to the GASB (Governmental Accounting Standards

Q8: Certain balance sheet accounts of a foreign

Q10: The following information has been taken from

Q16: E-mail messages written in all capital letters

Q26: On October 1, 2011, Jarvis Co. sold

Q32: You are responsible for eliminating waste and

Q39: What are the five types of governmental

Q53: Jerry, a partner in the JSK partnership,

Q54: The primary message of the e-mail should:<br>A)

Q73: Do not eat or tend to personal