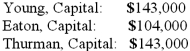

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Eaton's Capital account at the end of the first year?

Definitions:

Import Quota

A government-imposed limit on the quantity of a specific good that can be imported into a country, aimed at protecting domestic industries.

Tariff

A tax imposed on imported goods, often used to protect domestic industries from foreign competition and to raise government revenue.

Tax Revenue

The income that is gained by governments through taxation, which is used to fund public expenses.

Import Quota

A government-imposed limit on the quantity of a specific good that can be imported into a country.

Q7: A local partnership has assets of cash

Q12: Esposito is an Italian subsidiary of a

Q25: Coyote Corp. (a U.S. company in Texas)

Q33: Norton Co., a U.S. corporation, sold inventory

Q41: Computer hygiene includes:<br>A) Routinely scanning for viruses<br>B)

Q43: Car Corp. (a U.S.-based company) sold parts

Q69: Under the current rate method, property, plant

Q82: Brisco Bricks purchases raw material from its

Q89: Wilson owned equipment with an estimated life

Q103: Stark Company, a 90% owned subsidiary of