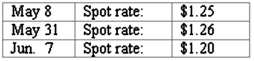

Brisco Bricks purchases raw material from its foreign supplier, Bolivian Clay, on May 8. Payment of 2,000,000 foreign currency units (FC) is due in 30 days. May 31 is Brisco's fiscal year-end. The pertinent exchange rates were as follows:

For what amount should Brisco's Accounts Payable be credited on May 8?

Definitions:

Process Costing

An accounting method used where costs are accumulated for a continuous process and then assigned to individual units of output.

Equivalent Units

A concept in cost accounting used to allocate costs to partially completed goods, making them comparable to fully completed units.

Conversion Costs

Costs incurred when converting raw materials into finished products, typically including labor and overhead expenses.

FIFO Method

"First In, First Out," an inventory valuation method where goods first acquired are the first to be sold, affecting inventory and cost of goods sold calculations.

Q16: Patti Company owns 80% of the common

Q41: On October 1, 2011, Eagle Company forecasts

Q46: Perry Company acquires 100% of the stock

Q49: The Henry, Isaac, and Jacobs partnership was

Q74: A $910,000 bond was issued on October

Q75: Common portable communication devices include:<br>A) Cell phones<br>B)

Q80: Walsh Company sells inventory to its subsidiary,

Q89: Forwarding non-work-related e-mail messages is acceptable in

Q90: A historical exchange rate for common stock

Q99: McGuire Company acquired 90 percent of Hogan