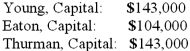

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Thurman's total share of net income for the second year?

Definitions:

Low-Income Countries

Nations with a gross national income per capita below a certain level, characterized by limited industrial development and low human development indicators.

Women's Status

Refers to the social and legal position of women in society, which can vary widely across different cultures and historical periods.

Dependency Theory

A perspective in international relations and economic development that examines how developed nations perpetuate the underdevelopment of developing nations through a dependence on the global capitalist system.

Former Colonies

Territories that were once governed and exploited by a foreign power but have since gained independence.

Q11: A(n) _ is a visual display of

Q24: Stark Company, a 90% owned subsidiary of

Q31: On January 1, 2011, Harrison Corporation spent

Q33: A foreign subsidiary uses the first-in first-out

Q40: Some rules for the use of a

Q40: Ginvold Co. began operating a subsidiary in

Q42: When using a speaker phone<br>A) Ensure confidentiality

Q57: Governmental funds are<br>A) Funds used to account

Q88: What theoretical argument could be made against

Q96: The following information has been taken from