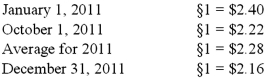

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Accounts Receivable

Accounts receivable is the money owed to a business by its clients or customers for goods or services delivered but not yet paid for.

Electronic Funds Transfer

A system that allows the transfer of money between bank accounts without the physical exchange of cash, checks, or other negotiable instruments.

Outstanding Checks

Checks that have been issued and recorded in the payer's financial statements but have not yet been cashed or cleared by the bank.

Bank Reconciliation

The method of aligning the figures in a company's financial records for a cash account with the relevant data on a bank statement.

Q15: Cashen Co. paid $2,400,000 to acquire all

Q19: On October 31, 2010, Darling Company negotiated

Q26: Hardin, Sutton, and Williams have operated a

Q28: When in doubt regarding the appropriateness of

Q44: Coyote Corp. (a U.S. company in Texas)

Q72: At work a phone call should be

Q76: Gargiulo Company, a 90% owned subsidiary of

Q79: Difficult customers are rare.<br>

Q90: Caldwell Inc. acquired 65% of Club Corp.

Q108: Company _ are broad statements or aims.