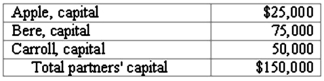

The partners of Apple, Bere, and Carroll LLP share net income and losses in a 5:3:2 ratio, respectively. The capital account balances on January 1, 2011, were as follows:

The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values. Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. The amount of cash that Dorr should invest in the partnership is:

Definitions:

Considerations

Factors thought about or taken into account before making a decision or judgment.

Brick-and-mortar Stores

Physical retail outlets located in buildings as opposed to online or virtual shops.

Reciprocal Pricing

Reciprocal pricing is a pricing strategy where competitors agree, either formally or informally, to set prices at a certain level, often to stabilize market conditions or ensure mutual profitability.

Contract Manufacturers

Companies that produce goods under contract for other companies, under the branding of the latter, often as a cost-saving measure.

Q21: Boerkian Co. started 2011 with two assets:

Q22: A partnership began its first year of

Q24: Cleary, Wasser, and Nolan formed a partnership

Q26: On October 1, 2011, Jarvis Co. sold

Q31: Farley Brothers, a U.S. company, had a

Q64: Old Colonial Corp. (a U.S. company) made

Q77: Walsh Company sells inventory to its subsidiary,

Q78: Chain Co. owned all of the voting

Q79: Strickland Company sells inventory to its parent,

Q108: On January 1, 2010, Smeder Company, an