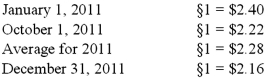

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Oversight

The process of monitoring and evaluating the operations and activities of a government or organization to ensure they are compliant with laws, regulations, and standards.

Congress

The national legislative body of the United States, consisting of the House of Representatives and the Senate, responsible for making federal laws.

Legislation

Laws or statutes that have been enacted by a legislative body such as a parliament or congress.

Enumerated Powers

These are specific powers granted to the Congress by the United States Constitution, including the ability to tax, to declare war, and to regulate interstate and foreign commerce.

Q16: Cleary, Wasser, and Nolan formed a partnership

Q17: A company's _ is the company's viable

Q18: Pell Company acquires 80% of Demers Company

Q21: On October 1, 2011, Eagle Company forecasts

Q37: Which of the following statements is true

Q44: When preparing a consolidation worksheet for a

Q59: Norr and Caylor established a partnership on

Q72: Pell Company acquires 80% of Demers Company

Q81: Panton, Inc. acquired 18,000 shares of Glotfelty

Q83: A net liability balance sheet exposure exists