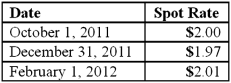

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the amount of Cost of Goods Sold for 2012 as a result of these transactions?

Definitions:

Irrational

Acting without or against reason; not based on logical, rational thinking.

Immoral/Unethical Acts

Behaviors or actions that are considered wrong or unacceptable based on societal norms or ethical standards.

Non-Deontology

A term incorrectly formed and likely refers to ethical theories not based on duty or rules, such as consequentialism or virtue ethics; however, the correct term does not exist in standard ethical discussions, so I'll mark it as NO.

Intrinsic Worth

It refers to the inherent value that something has in itself, irrespective of its utility to others.

Q31: Under modified accrual accounting, when should an

Q36: Pepe, Incorporated acquired 60% of Devin Company

Q69: P, L, and O are partners with

Q71: What are the two groups of financial

Q77: Quadros Inc., a Portuguese firm was acquired

Q78: Certain balance sheet accounts of a foreign

Q82: Gargiulo Company, a 90% owned subsidiary of

Q84: On January 1, 2011, Musial Corp. sold

Q98: Pell Company acquires 80% of Demers Company

Q125: Walsh Company sells inventory to its subsidiary,